Fast, Secure & Transparent Loan Solutions

Get instant access to funds with Rupee Ease—your trusted loan assistance platform.

TRY FOR FREE

Get instant access to funds with Rupee Ease—your trusted loan assistance platform.

TRY FOR FREE

Rupee Ease connects you with trusted NBFCs, ensuring a seamless, secure, and fully digital borrowing experience. Whether it’s for medical emergencies, education, or daily expenses, we help you find the right loan solution without hidden charges or collateral requirements.

All loans are provided by Indequip Leasing & Finance Limited, an RBI-registered NBFC. Rupee Ease acts as a bridge, making loan access simple and efficient while maintaining complete transparency.

Get quick approvals and fast fund transfers directly to your bank account.

Apply for a loan without pledging any assets or providing a guarantor.

A fully digital process with encrypted transactions to keep your data safe.

Choose a loan amount and tenure that best suits your financial needs.

No hidden charges—everything is clearly communicated upfront.

All loans are issued by Indequip Leasing & Finance Limited, an RBI-registered NBFC.

Rupee Ease does not directly provide loans. All loans are issued by Indequip Leasing & Finance Limited, a registered NBFC in India. Rupee Ease serves as a platform that connects users with the NBFC for a seamless and transparent borrowing experience.

To apply for a loan through Rupee Ease, you must:

Be an Indian citizen

Be between 22 and 58 years old

Have a stable job or reliable income source

Rupee Ease offers loan amounts up to ₹300,000, with repayment periods ranging from 90 to 720 days. The maximum annual interest rate is 21%, and a service fee of up to 2% may apply.

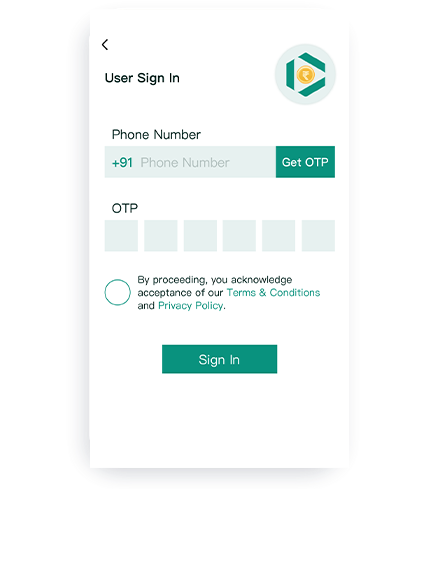

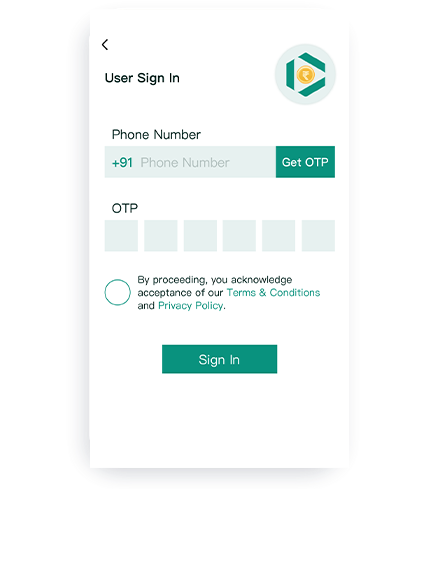

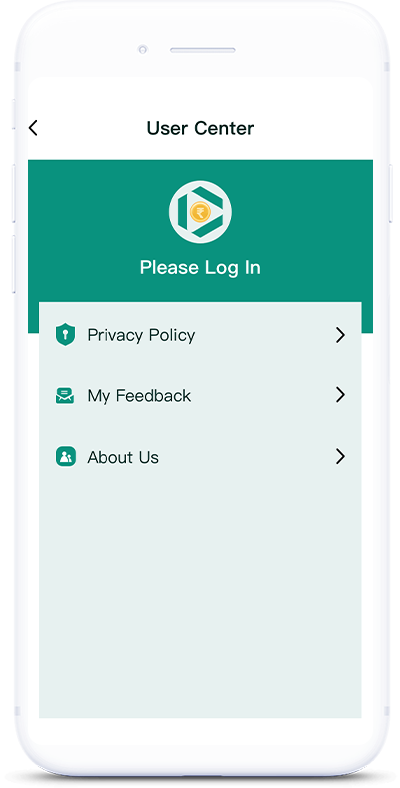

Applying for a loan is quick and fully digital:

Install the Rupee Ease app

Register with your mobile number

Submit your personal and financial details

Wait for approval

Receive funds directly in your bank account upon approval

Rupee Ease partners with Indequip Leasing & Finance Limited, an RBI-registered NBFC, to provide secure and transparent loan services. As our official lending partner, they ensure compliance with financial regulations, offering flexible loan solutions to help users meet their financial needs quickly and efficiently.

Learn more: https://www.indequipleasingfin.com/